Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Mar-11-2013 10:00

TweetFollow @OregonNews

TweetFollow @OregonNews

Hey, America! Revolution, Civil War or Tyranny--Take your pick!

Daniel Johnson, Deputy Executive EditorAmerica has moved backward over the last half century. There is now representation without taxation, the opposite of the nation's founding philosophy.

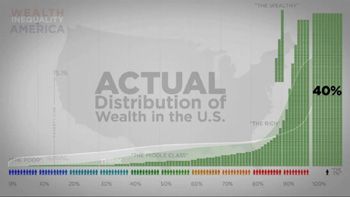

Top 400 people have more money than the bottom 150 million combined! |

(CALGARY, Alberta) - I read a comment to a news story recently:

“Every one of ‘We The People’ is an equal owner in this thing we call the US of A. The land, the water, the sky. The government is our family business. Some of 'US' receive very little in return for the use of our share by others. When Canadian firms mine our public lands, when British firms drill for oil in our waters, when global capital of all types monopolizes our business sectors making it hard for 'US' to start and run decent small firms, why are 'WE' not included as shareholders in the work. It is reasonable for all 'The People' to be included in the profits, and in the planning. Some might call it socialism but those making the suggestion are usually the one's doing the taking. The rest of us might call it fairness.”

The reality in modern American society is chillingly shown in this The reality in modern American society is chillingly shown in this six minute video.

America has moved backward over the last half century. There is now representation without taxation, which is the opposite of the founding philosophy. What America has now is a culture where a few thousand people control the political and corporate worlds and are not taxed. Because they control the political process, they have almost entirely freed themselves of a tax burden. This is famously demonstrated in the case of Warren Buffet who has argued (disingenuously, I suggest) that he should have a higher tax rate than his secretary. He was paying taxes on his income at 17% and his secretary (at an apparent $60k salary) was paying nearly double--30%.

The late economist John Kenneth Galbraith distilled the process into a rule:

"As power [flows] down, income extracted thereby flowed up. It’s a rule worth having in mind. Income almost always flows along the same axis as power but in the opposite direction."

Here's the Galbraith rule in a four minute video "The rich aren't giving you money, they're taking your money":

America is no longer No. 1. A great nation doesn’t torture people and make them disappear without a trial.

Galbraith described, more than 30 years ago, the normal result of the first inequality video above:

"In 1774, [Anne Robert Jacques] Turgot became Comptroller-General of France, and his task was to curb the extravagance of the French court and thus to reduce the burden on the ‘produit net’....He failed. A firm rule operated against him. People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right. The sensitivity of the poor to injustice is a trivial thing compared with that of the rich. So it was in the Ancien Régime. When reform from the top became impossible, revolution from the bottom became inevitable."

Tea Party

The U.S. has become so polarized, that the slogan of the Tea Party movement revolves around the theme of “taking the country back”. Those who follow the TP don’t understand that that the tea baggers are the equivalent of an American Taliban

A new direction America began its Revolution as a protest against Taxation without Representation. But, over two centuries, this has become reversed so that now America has Representation without Taxation; i.e., the 1% own the government and the Supreme Court and thus present themselves as representing all Americans and are not taxed (except minimally)—Representation without Taxation!

Here is how it happened and continues to happen, as described by Ferdinand Lundberg in The Rich and the Super-Rich (1968).

Louis B. Mayer, the movie mogul had a special tax law drafted and passed for him personally. In such a case, Lundberg writes, the law as written is a complete mystery to the Treasury Department people until one day, a return is received that uses that section. “Then it is seen, in a flash, that the return fits the law as neatly as a missing piece fits into a jigsaw puzzle.”

“The experts in the Treasury Department were mystified upon first reading Section 1240 of the Internal Revenue Code of 1954, written in customary opaque tax language…What it said was:

“’Amounts received from the assignment or release by an employee, after more than 20 years’ employment, of all his rights to receive, after termination of his employment for a period of not less than five years (or for a period ending with his death), a percentage of future profits or receipts of his employer shall be considered an amount received from the sale or exchange of a capital asset held for more than six months if (1) such rights were included in the terms of employment of such employee for not less than 12 years, (2) such rights were included in the terms of the employment of such employee before the date of enactment of this title, and (3) the total of the amounts received for such assignment or release is received in one taxable year and after the termination of such employment.’”

What this meant was Mayer and no one else may receive all future profits in the company in one lump sum which will be taxed at 25% as a capital gain even if it is in no way a capital gain. As a result of this special ruling he benefited by $2 million (in a day when $2 million actually meant something).

How did he get this unique treatment? His attorney was Ellsworth C. Alvord who appeared before the Senate Finance Committee, not as Mayer’s attorney, but on behalf of the U.S. Chamber of Commerce.

In 1968, Lundberg described the tax structure as “a pullulating excrescence negating common sense, a parody of the gruesomely ludicrous, a surrealist zigzag pagoda of pestilent greed, a perverse thing that makes the pre-revolutionary French system seem entirely rational.”

Looking at the economic situation, the tax system has obviously degenerated in the intervening half century. The day is not far away (thanks to the internet) when a critical mass of Americans are going to become aware of the incredibly unfair distribution of wealth in the country and they are going to be mad as well and will refuse to take it anymore.

The two obvious potential outcomes are a Second American Revolution or a Second Civil War. With the number of guns available and the susceptibility of the bulk of Americans to being brainwashed and set against each other, a Second Civil War is a distinct possibility.

But, if cooler hotheads prevail, a Second American Revolution is possible and could yield the better outcome.

This is where democracy would have to reinstate itself. All the domestic enemies of America would have to be swept away—conservatives, Republicans and fellow travelers. Then, with an elected (people’s) government in charge, some changes could be made. The Tax Act, is a single law—despite it’s hundreds of turgid pages—and it could be repealed in its entirety. In advance a new, fairer, tax system could be written and on repeal of the old, it could replace it so that the country would be without a tax system for a few hours at the most.

Once the 1% (and their fellow travelers) start paying higher taxes, like they did under Eisenhower in the 1950s, both the deficit and the national debt could be tackled. Unfortunately, that doesn’t address the fundamental problem of the greatest wealth inequality in history outside the Egyptian pharaohs and pre-Revolutionary France, existing today in America. That means that the Constitution would have to be amended, perhaps even rewritten to allow for confiscatory taxation of excess, unearned, wealth. The Walton family are the poster children for this concept.

Christy Walton, Jim Walton, Alice Walton, S. Robson Walton, Ann Walton Kroenke, and Nancy Walton Laurie have a combined net worth of about $116 billion according to Forbes 400. Did any of these six people earn any of their wealth? No, they are all inheritors. So, what society gives, society can take away. Their fortunes could reasonably (although not from their vulture vantage points) be reduced to $30 or $40 million each. The New Constitution could cap fortunes (actually, rein in predatory capitalism), no matter how acquired .

Or take Charles and David Koch at $31 billion each. Did they work for their fortunes? They have worked and presumably very hard, but definitely not a million times harder than any of their employees. In addition, their fortune comes from extraction industries—resources that belong all Americans. So it would be fair to cut them back to $30 or $40 million each.

What I am arguing is that if people want to acquire a fortune allowable by the commonweal and sit back and just relax and do no work for the rest of their lives, that’s okay. It is just not right that they do it at the expense of everyone else.

I’m not going any further at this point but just pose the question: Could such an idealistic situation ever evolve? Watch this video (four minutes) and you decide.

"Americans will do anything to each other for money."

Daniel Johnson is a born and raised Calgarian. He is currently working on a book The Occupy Wall Street User Manual which is scheduled for publication in spring 2013 by Polymath Press

In 1990 he published his first (and so far, only) book: Practical History: A guide to Will and Ariel Durant’s “The Story of Civilization” (Polymath Press, Calgary)

Newly appointed as the Deputy Executive Editor in August 2011, he has been writing exclusively for Salem-News.com since March 2009 and, as of summer 2012, has published more than 210 stories.

View articles written by Daniel Johnson

Daniel Johnson is a born and raised Calgarian. He is currently working on a book The Occupy Wall Street User Manual which is scheduled for publication in spring 2013 by Polymath Press

In 1990 he published his first (and so far, only) book: Practical History: A guide to Will and Ariel Durant’s “The Story of Civilization” (Polymath Press, Calgary)

Newly appointed as the Deputy Executive Editor in August 2011, he has been writing exclusively for Salem-News.com since March 2009 and, as of summer 2012, has published more than 210 stories.

View articles written by Daniel Johnson

Articles for March 9, 2013 | Articles for March 11, 2013 | Articles for March 12, 2013

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Daniel Johnson March 14, 2013 4:02 pm (Pacific time)

http://www.pbs.org/wgbh/pages/frontline/untouchables/

Vic March 14, 2013 8:18 am (Pacific time)

"In the end, our ability to adjust ...to each new loss of freedom, each new "sacrifice", was more dangerous to us than they were" Author (awesome author)Ursula Hegi on life in Nazi Germany

Anonymous March 12, 2013 2:41 pm (Pacific time)

I think we should just let the queen/vatican/london/D.C. continue their control. They have been doing such a great job so far..And I love that they push eugenics thru poisoning our food, water, vaccines, chemtrails. Once they bring down the U.S., their last feat, the planet is done and over. Its about time, we all should die and let the few run things with robots. This is in their books, written for everyone to see. https://www.youtube.com/watch?v=pEydmE57Vew

Anonymous March 12, 2013 12:20 pm (Pacific time)

Mr. Writer this is the same ol' leftist propaganda from the 60's, just updated. Maybe if you were writing from a place of real experience coupled with rejection of "making too much" it would have more meaning? Why not go after super-rich like John Kerry, Nancy Pelosi, NYC Mayor Bloomberg(he was over-ruled on Nanny-soda recently), Hollywood moguls, Diane Feinstein, Kennedy's, Bill Cosby, Oprah, NBA basketball players, Michael Moore, Sean Penn,ad nauseum? Well, if you compare societal contributions of conservatives and liberals you quickly find out that it is the conservatives that have the greatest positive impact on the entire world. Of course this reality will not fit the leftist narrative, thus actual facts do get out and that means you are ultimately impotent, and always will be. I imagine you never reflect on the obvious fact that your ability to write the above is because of rich white Americans who also help feed the world and provide massive assistance to the world's poor. Maybe a little background on American economics and tax law would help you realize that those leftist blogs you go to have no real facts to back up their distractions. Easy to cherry pick (trees), but that is why you have no idea what the forest is all about. You are enjoying your life span because of those who become super rich on their own, and most do it on their own not inheritance like the Rockefellers, Kennedys and those of similar ilk. Just the same, it is the charitable contributions of all those in American society, rich and poor, who help the world. It is very rare to see liberals help anyone with their own assets, just other people's money, which is what got us into this mess. We in time will remove them from the equation of power, with finality.

So, 400 people have more wealth than the bottom 150,000,000 combined. That's okay with you? America is just inches away from tyranny. Your democracy has been eviscerated and its resurrection is the only avenue that can save your country. Good luck with that.

Rob March 12, 2013 7:40 am (Pacific time)

The solution sound good on paper.

One thing that is very critical to keep things going in any capitalist country is the availability of capital to enterprise. I had a discussion with a Russian recent immigrant a few days ago. The trouble in Russia is that all the wealth is in the hands of even fewer people than in the US. There is a lot less of it and they are not willing to risk it where laws are weak and law enforcement is even weaker. They and foreign sources of capital are not willing to risk losses due to an unstable government as opposed to simple business forces.

Consequently, there is not enough development and not enough jobs being created and therefore wages are low for those who are lucky enough to get a job and life is tougher than it should be. Poverty levels are much higher than they are in the western world.

I wonder how the idea of clawing back from the rich what they don’t work for reasonably affects their willingness to invest in risk based development.

The Walton’s may be worth the billions you claim but that money is not sitting in a bank somewhere waiting to be taken away by the government. It is surely all invested in capital projects and other assets of various kinds. This is the way they avoid paying taxes on it in the first place. A building was built with it for example. Or it was loaned to a number of mortgages which supported the building of housing.

If the government took all their wealth except for 1 billion let’s say, what would it do with it? Sell all the assets to pay back debt. How would that generate jobs for tax paying folks who create more wealth and generate more tax revenue to pay down the debt further. That kind of thing might create a slump in the asset market which will make investors stay away from the market and create even greater losses. Such a move would surely create a sour investment environment for others to begin to shy away from and that would depress the economy further and reduce jobs which would reduce taxes which would degrade even further the government’s ability to take care of the poor and the elderly.

I know this sounds pessimistic but when the survival of humans on the planet appears to depend on the availability of huge amounts of capital investment you have to think twice about creating a less safe investment environment.

If something like what you suggest is to happen, there will have to be some kind of way to do it so that the assets are transferred slowly perhaps. Even then, if I had that kind of money and the government was going to take it, even slowly, I would liquidate, pay the taxes as necessary and move it off shore. Too much of that kind of stuff is not going to help anyone.

Good response. But you're still focusing on the old capitalist model. What about human capital? There is no place in your model for the value of human beings as human beings.

BM March 11, 2013 6:34 pm (Pacific time)

We need to regulate the banks. We need to overhaul immigration. We need to end corporate welfare, including the Pentagon. We need to bring troops home, from everywhere. We need to end the drug war. And we need to put terrorists and other human rights violators on trial in civilian court, starting with Dick Cheney.

Anonymous March 11, 2013 6:04 pm (Pacific time)

Myth, as per taxing equality: "...Warren Buffet who has argued (disingenuously, I suggest) that he should have a higher tax rate than his secretary..." This is a capital gains tax v.s. an income tax. I myself also have as part of my tax filing where on my normal income I pay a whole slew of taxes. Then on investments from money I already paid income tax on I then pay additional taxes (Capital gain tax). For example say I lose $100,000 on an investment then I can only write off $3,000, but if I make $100,000 via my "risk-taking" investment I pay the full tax, generally 15%. Note: American corporations pay some of the highest Corporate tax rates both federal and in some states in the world. Those states that have the lowest tax rates generally have the most per capita (private market) income and the lower unemployment rates. Most people in certain areas who sell their homes can get a tax-free amount from their home sale, but after that ceiling amount they pay the full capital gains tax. Many people after their home sales actually become 1% percenters for that tax year of home sale. Without risk-taking investment with money that was gotten after paying the full amount of tax, we simply would be even more stagnant than we are because of demo policies.

The tax revenus during the Eisenhower Administration is just a small fraction of current revenue. Even our current military expenses are far less than this [mostly] peacetime era. This year and in 2007 were record tax revenue periods. The tax rates from earlier times had many tax saving methods available. We need to curb spending for just look at places like California...they are essentially bankrupt because of government spending and are now discussing taxing "emails." It is the far left libs that have caused this mess, and it is conservatives that are trying to turn it around. We owe a debt to people like those in the Tea Party who are simply advocating reining in spending. The marxists hate them because they know the TP/conservatives (conservatives are the largest group in America at over 43% while liberals are less than 20%) in time will destroy them. God Bless America and our Bill of Rights. Pass the Ammo, and the truffles.

Good job, Mr. Shill. You've tried to totally change the subject which is the dangerous concentration of wealth in America--greater than 1929 and greater than the 1890s. This is one area where America is, indeed, No. 1. No other democratic industrialized nation comes close. And it promises to be your nation's undoing.

BTW, I guess you didn't watch the video showing how the TP is really An American Taliban.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.