Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Oct-09-2012 14:37

TweetFollow @OregonNews

TweetFollow @OregonNews

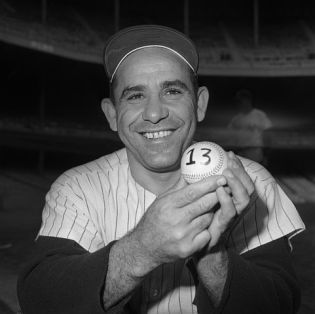

It's a Yogi Berra market... Gentlemen Prefer Bonds

(All others buy stock)

Bill Annett Salem-News.com

When the rank and file are climbing on the caboose, you'll see me jumping off the locomotive.

- Joe Granville

The Kansas City Guru

Famous press photo of Yogi Berra courtesy: askville.amazon.com |

(DAYTONA BEACH, FL) - Yogi, thou should be behind the plate at this hour.

We need your insight, Yogi. You should be saying something like: "So many people are nervous about the stock market these days, that it's hit a new high."

You said something similar a few years ago about the cycle in restaurant popularity, and we all had a good yuk.* The trouble with the stock market is, it's almost ALWAYS a Yogi Berra market: it continues to fluctuate, while the average person is almost always wrong, and is usually fluct as a result.

Au contraire, the most successful investors tend to check out which way the crowd is going and head in the opposite direction. Sir John Templeton said: "Sell when others are avidly buying; buy when others are despondently selling." Sir John, the patron saint of a book Gordon Stenner and I wrote aeons ago, ended his days owning half of Bermuda, a knighthood and a universe of mutual funds in partnership with the late Ben Franklin (in name, if not in person). Ben may have invented the electoral college, electric kites and the Saturday Evening Post, but Sir John Templeton sanctified the mutual fund.

My opening salvo above illustrates Joe Granville's endorsement of the same principle, and Joe has been calling 'em right since Warren Buffett was in knee pants, before, like the rest of us, Buffett had even read Ben Graham in Finance 101.

So what are we to think of the mocket today? The presidential election this year is sending out the usual deep-seated whispers, and you'll recall that in Finance 101 we all learned that election-October has ALWAYS produced a bull market, right back to William Jennings Bryan. Why? Because every Oval Office aspirant is promising the moon to the voters - suppressed, disqualified and swing. (Swing voters this year are like Tommy Dorsey, Benny Goodman and Duke Ellington - rendered partially obsolete by faulty voting machines, gerrymandering and widespread lack of photo I.D., trumped up by enterprising Republican voter suppressionists and State Governors.)

The enthusiasm over the stock market is apparent in some quarters. Take the experts. Please. Mirror, mirror on the wall (that is the Street named Wall), who is the wisest guy of all?

How about the boss investment officer at Vanguard which, in case you haven't heard, a year or so back passed Fidelity and American Funds to become the largest mutual fund group in the country? The guy's name is Gus Sauter, and he's ultimately responsible for something like $1.1 trillion (that's a "t") in assets. Noting the fact recently that, despite the recent strength (12% this year) in the stock market, there seems to be a widespread suspicion of where it's going, Sauter is quoted as saying: "I like the fact that everyone is worried about the stock market. That's when the market is set up to do well. More than 90% of my money is in equities."

Still, the present bovine bash is more like a steer than a bull market: the occasional dash of sound and fury, but without the cajones, signifying nothing. The enthusiasm is strong in some quarters, as already mentioned. But why, for example are so many professionals eschewing the stock market these days, choosing instead the bond market that offers dismally low yields, especially in the high-grades, the government Treasury issues, that yield almost nothing, except for a warm, safe feeling?

In the last quarter, the 8,000 individual diversified stock mutual funds in the United States, with total assets pushing $4 trillion, appreciated an average of about 5 1/4%. Not too shabby, compared with the rise of a shade over 2% in bond mutual funds in the same period, so that old bond fund pros like Bill Gross of Pimco have been doing a double take, both privately and in the media, commenting on the relative value of equities these days.

But contrarily, which might serve as the single-word title of this piece, in the single month of August, those same stock funds faced net divestment (which means investors running for the exit) to the tune of $13.5 billion, the 16th consecutive month for such outflows, while the poor-return bond funds saw a net INFLOW of $32.4 billion, added to a similar influx for each of the 12 preceding months. When gentle retail investors, in addition to gentlemen, prefer bond funds, something is definitely wrong with this bull-market picture.

In other words, if inflation can be assumed to exceed 2% and change, the thundering herd of investors are jamming the equity exit in favor of the stodgy medium, even though bonds, not because bonds are more fun, provide a negative yield after tax.

You see what I mean about a Yogi Berra market?

It's also a make-out market, defying common sense, reflecting a Street of Dreams so contradictory that it can celebrate the kingship status of the biggest buccaneer while acknowledging, almost grudgingly, the phoenix-like rise of a good-guy organization. Let me illustrate, but briefly.

Goldman Sachs, the King of Candyland in the Wall Street confecionery, believe it or not is the sole strong survivor standing among conventional investment banks not melted down in the late lamented financial Chernobyl. Lehman Brothers went toes-up on the table, Morgan Stanley retreated gracefully into "wealth management," Citibank went international to protect the innocent, and JPMorgan Chase buried its identity in a couple of illicit affairs with sirens like Bear Stearns and Washington Mutual. Goldman alone, selon Michael Santoli of Barrons, sailed on successfully as the most successful fox in the subprime mortgage henhouse, the bullgoose investment bank and institutional trader in the barnyard east of Trinity Church.

And the inhabitants of the farm are cheering. "The company maintains an abiding leadership position in most of its activities, and is financially sturdier and less burdened by irrational competition than it was a half-decade ago,:" says Santoli. "It's easy to conclude that the shares could rise at least 25% within a year."

No doubt Lloyd Blankfein, the CEO at the tiller will be asking for a raise. The 100 mill he's getting now is probably inadequate for such a superlative risk manager.

At the same time, the Street recognizes true grit when they see it, which isn't often these days. Neuberger Berman is an old-time Wall Street house, battered by its adoption by Lehman Brothers before they were forced to drink the hemlock. Buyouts were proposed for Neuberger but never materialized. They fortunately avoided being sodomized by none other than Bain Capital, (Mitt was long gone, of course - at least in person) and Neuberger's directors wisely hit on the solution of becoming employee-owned, a rarity indeed on Wall Street, which is usually peopled by ancient partnerships or, more recently, public companies.

Employee ownership, unlike the other corporate organizations, dictates a different sort of mission, measuring its success by how the partners, employees and clients feel about it. According to CEO George Walker, rather than striving for growth as the centerpiece of corporate strategy, the focus is on "the stewardship of client capital and the franchise."

Sounds hackneyed, but rare among what Santoli refers to as the "bulge-bracket banks" along the Street. Employee ownership tends to confound both unions and tycoons. And it offers another example of the contradictions of a culture that sees gentlemen preferring bonds at less than break-even potential, while shunning what is - these days in the election season - daily exposited by the Yogi Berra stock market.

_________________

*Actually, what Yogi said was: "That place has become so popular that nobody goes there any more."

Bill Annett grew up a writing brat; his father, Ross Annett, at a time when Scott Fitzgerald and P.G. Wodehouse were regular contributors, wrote the longest series of short stories in the Saturday Evening Post's history, with the sole exception of the unsinkable Tugboat Annie.

At 18, Bill's first short story was included in the anthology “Canadian Short Stories.” Alarmed, his father enrolled Bill in law school in Manitoba to ensure his going straight. For a time, it worked, although Bill did an arabesque into an English major, followed, logically, by corporation finance, investment banking and

He also contributed to The American Banker and Venture in New York, INC. in Boston, the International Mining Journal in London, Hong Kong Business, Financial Times and Financial Post in Toronto.

Bill has written six books, including a page-turner on mutual funds, a send-up on the securities industry, three corporate histories and a novel, the latter no doubt inspired by his current occupation in Daytona Beach as a law-abiding beach comber.

You can write to Bill Annett at this address: bilko23@gmail.com

|

|

|

Articles for October 8, 2012 | Articles for October 9, 2012 | Articles for October 10, 2012

Salem-News.com:

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.